Rate TaxRM A. You can file your taxes on ezHASiL on the LHDN website.

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

The flat tax fee of RM20000 is abolished for trading companies including all licensed entities.

. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying. Assuming that the exchange rate on 1532019 was RM420 USD1 the RM equivalent is RM42000. Tax Booklet Income Tax.

On 1532019 the company was invoiced for the purchase of trading stock from a supplier in the United States of America USA for USD10000. Now that youre up to speed on whether youre eligible for taxes and how the tax rates work lets get down to the business of actually filing your taxes. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 72 as only 30 of its profits are subject to tax.

Pendapatan bercukai RM500000 pertama. Dealing with Malaysia entities is allowed with a tax rate of 3. Corporate - Taxes on corporate income.

The Latest Labuan Tax 2019 changes effective from 1st January 2019 is as follows. Our revolutionary technology changes the way individuals and. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia.

Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. An individual is considered tax resident if heshe is in Malaysia for 182 days or more in a calendar year. The company made the.

Tax rate for companies with a paid up capital in respect of ordinary shares of RM25 million and less at the beginning of the basis. Corporate tax highlights. Insights Malaysia Budget.

Last reviewed - 13 June 2022. On the First 5000. 92019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Modal berbayar sehingga RM25 juta pada awal tempoh asas. 6 December 2019 Page 1 of 19 1.

Corporate Tax The common corporate tax rate in Malaysia is 25. The Malaysian companies which transact with a Labuan entity are entitled to a tax deduction on. The current CIT rates are provided in the following table.

Chargeable income MYR CIT rate for year of assessment 20212022. Country Default Spreads and Risk Premiums. The deadline for filing income tax in Malaysia is 30 April 2019 for manual filing and 15 May 2019 via e-Filing.

On the First 5000 Next 15000. Tax Rate of Company. Objective This Public Ruling PR provides an explanation on the determination of the.

RPGT Payable Nett Chargeable Gain x RPGT Rate. It is the tax which is imposed on the gains when you dispose the property in Malaysia. Payment of the purchase was due on 1562019.

Knoema an Eldridge business is the premier data platform and the most comprehensive source of global decision-making data in the world. Subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person other than a company. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information.

RPGT stands for Real Property Gains Tax. In general corporations are taxed on income derived from Malaysia with the exception for banking insurance air transport or shipping sectors. Malaysia - Corporate Tax Rate.

Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019. For example if you bought a house for RM250K and sell it at RM350K the profit of RM100K is chargeable under RPGT but you may be entitled to deduct expenses such as. Companies are generally taxed at the corporate rate of 24 per cent.

For a company resident and incorporated in Malaysia that has a paid-up ordinary share capital of 25 million ringgit or less income tax is chargeable at a rate of 17 per cent for the first 500000 ringgit and 24 per cent for every ringgit thereafter. 20182019 Malaysian Tax Booklet Personal Income Tax 20182019 Malaysian Tax Booklet 23. Rates Real Property Gains Tax Stamp Duty Sales Tax Service Tax Other Duties Important Filing Furnishing Date.

Dari luar Malaysia bagi syarikat insurans pengangkutan laut dan udara dan perbankan sahaja. Tax Rate of Company.

Foreign Direct Investment Flows In The Time Of Covid 19

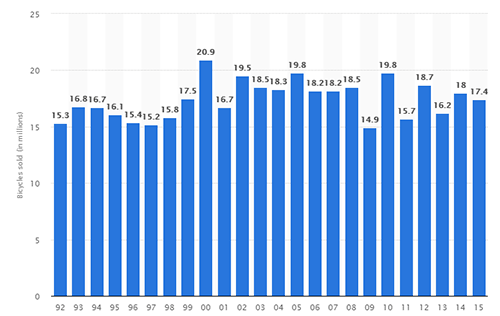

Bike Statistics And Facts 2019 Pioneer Sports

Income Tax Malaysia 2018 Mypf My

How Much Does The Federal Government Spend On Health Care Tax Policy Center

Foreign Direct Investment Flows In The Time Of Covid 19

2019 Q4 And Full Year Results Presentation Transcript Novartis

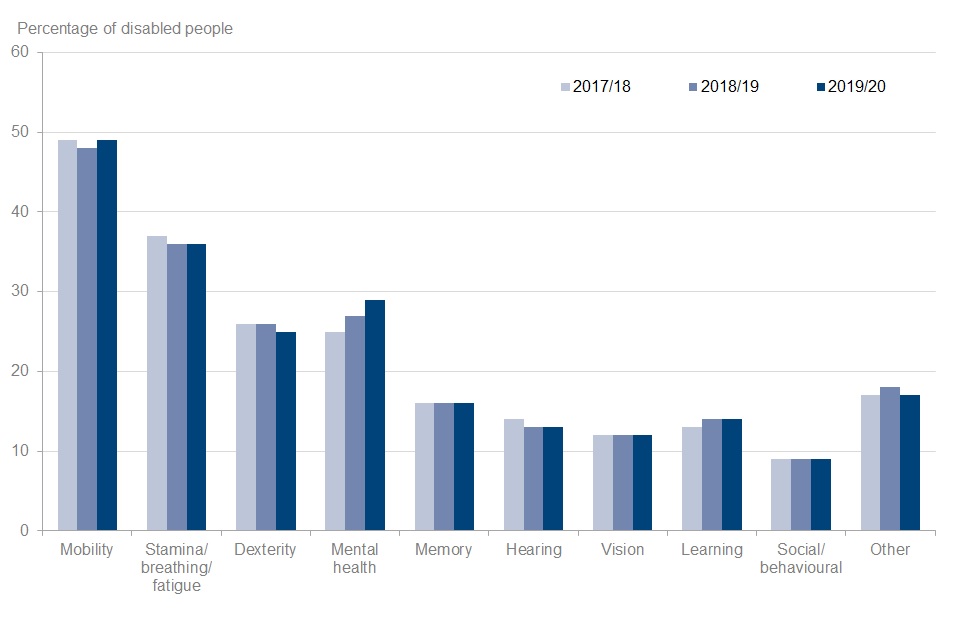

Family Resources Survey Financial Year 2019 To 2020 Gov Uk

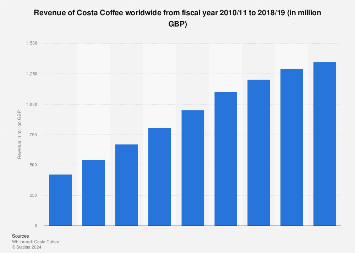

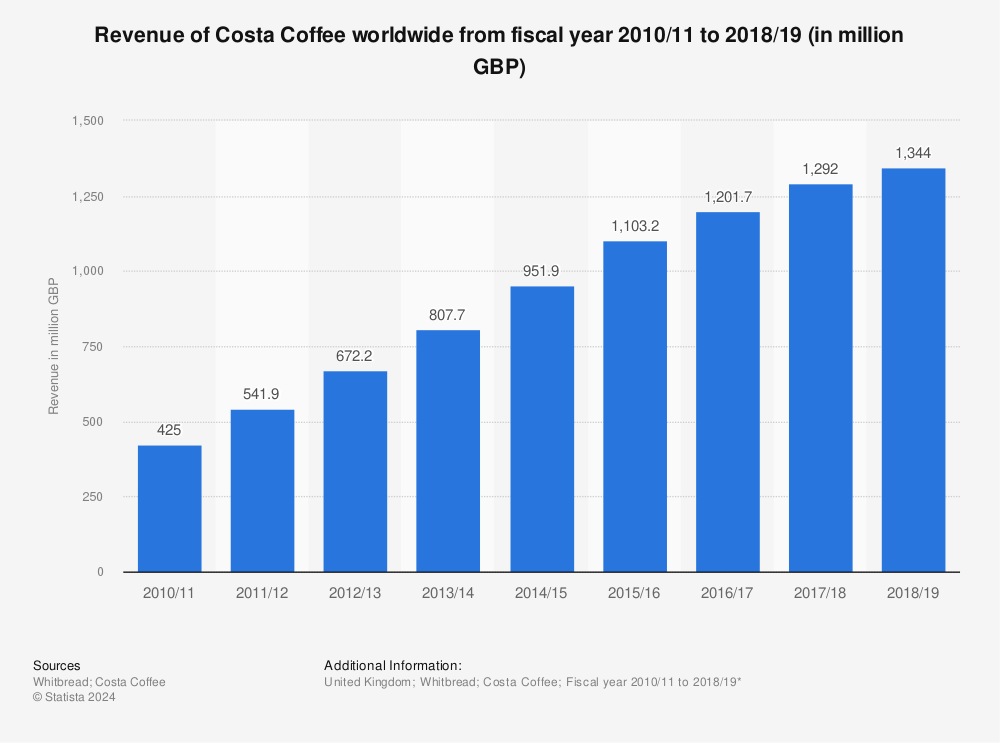

Costa Coffee Revenue 2010 2019 Statista

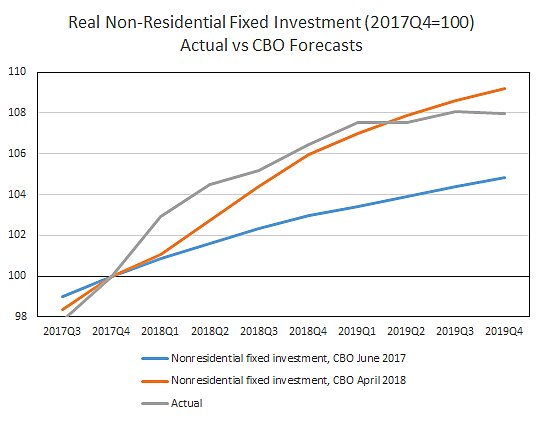

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

Civil Service Staff Numbers The Institute For Government

Teleworking In The Covid 19 Pandemic Trends And Prospects

Lithuania Corporate Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical

2020 E Commerce Payments Trends Report Malaysia Country Insights

Costa Coffee Revenue 2010 2019 Statista

Company Tax Rates 2022 Atotaxrates Info

China Loan Prime Rate 5y July 2022 Data 2019 2021 Historical August Forecast

2019 The Year Rainforests Burned

/cdn.vox-cdn.com/uploads/chorus_asset/file/16283662/Screen_Shot_2019_05_17_at_11.07.37_AM.png)

Fossil Fuel Subsidies The Imf Says We Pay 5 2 Trillion A Year Vox

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)